Payment Switch is a mechanism that allows multiple payment service providers to communicate with one another. The switch generally offers a rules-based authorisation and switching solution that is driven by the merchant.

Payment transactions are constantly routed between numerous acquirers and Payment Service Providers. It stands at the core of payment processing, acquiring, routing, switching, authenticating, and authorizing transactions across numerous payment channels in real-time. The switch makes it simple to expand the payment network by adding new payment methods and suppliers without incurring significant integration costs.

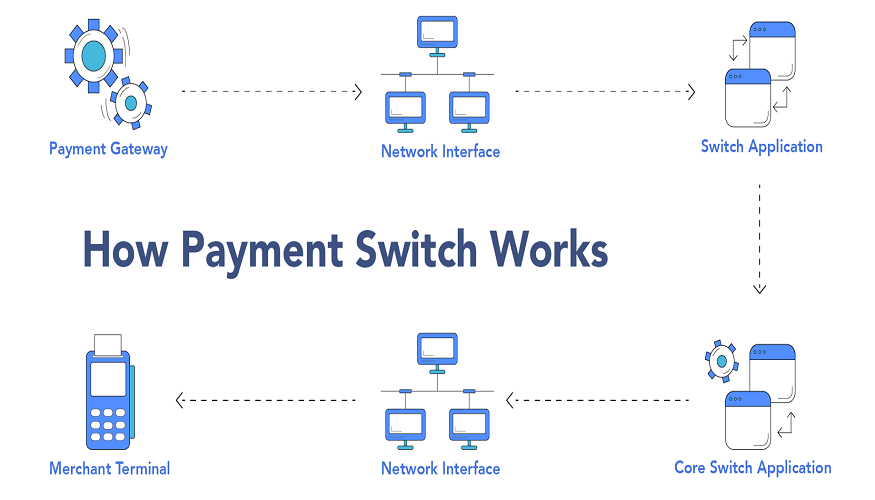

How does payment switch work?

- The payment switch authorizes the merchant and transaction when the payment request is initiated. The transaction is processed further depending on its state (failure or success).

- The switch then uses the rules to dynamically route allowed payment transactions.

- Routing by bank identity number, quantity, time of day, and so on are examples of these criteria. Switch prepares and transmits a message to the provider based on the bin identity, and receives a response from the provider.

- It prepares the received response once more before returning to the caller.

What to look for in a good payment switch?

Dynamic routing

Different acquirers’ acceptance rates change based on a variety of factors; switch analyzes these factors as rules and uses them to dynamically route transactions, optimizing payment acceptance and minimizing transaction failures.

Fraud Management

Every Payment Switch Provider should strike the ideal balance between a great user experience and strong fraud prevention.

Extension of payment network

Customers usually pay online using the method that is most comfortable for them. There are many payment switch providers on the market, and the number will continue to grow. Payment Switch should allow for the integration of different payment switch providers and worldwide acquirers, lowering the merchant’s integration costs.

Security

Security is one of the most critical features of online/digital payments. Payment Switch should use encryption and tokenization technologies, for the protection of both clients and businesses.

To Conclude

Payment switches will not go away since banks compete intensely to provide the best secure and quick payment ways. Only till the switch exists will payment initiatives pursue the revolution route.

The future, on the other hand, remains uncertain. As a result, the transition may be phased out in favour of a more powerful payment gateway technology in the future.