Working in healthcare can be very lucrative. Physicians especially have the potential to come into a lot of money as they work to save and improve the lives of others. As high-income earners, however, these professionals also face high expenses as they acquire a hefty amount of tax liability throughout the year. That, on top of paying back substantial educational dues, can drastically limit their budget.

Fortunately, there are ways to reduce such expenses despite being stuck in a high tax bracket. Below, we’ll go over a few “tax planning” tips to help physicians and other high-income medical professionals save their well-earned money going forward.

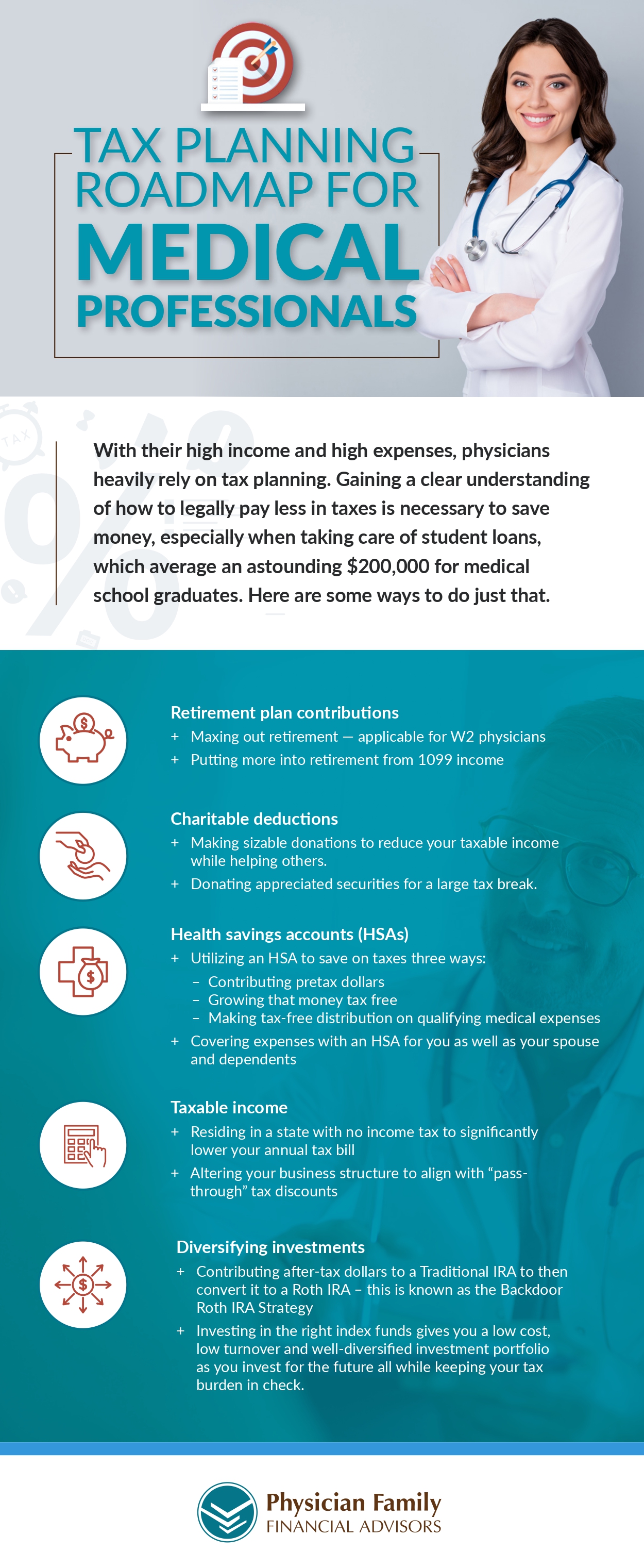

Tax Planning Roadmap for Medical Professionals from Physician Family Financial Advisors, a provider of financial planning services for physicians